【新唐人2011年5月6日訊】「美中戰略與經濟對話」將於下週在華盛頓舉行,人民幣匯率問題仍然是討論重點。美國財政部長蓋特納希望人民幣加快升值,而學者認為,中共政府的性質決定了它不能自由放開人民幣匯率。

第三輪「美中戰略與經濟對話」美方將由國務卿和蓋特納領銜,中方由國務院副總理王岐山帶頭,屆時美中將就事關兩國關係發展的一系列問題展開磋商。

美國財政部長蓋特納在最近表示,他將促使中國的官員實行一系列經濟改革,包括實行更靈活的、以市場力量驅動的匯率,和改善美國企業在中國的投資環境等。

蓋特納還說,這次會談的焦點還是人民幣與美元的匯率問題,人民幣升值對抑制中國的通貨膨脹有利,同時也可以防止中國國內的房地產泡沫繼續膨脹,目前中國領導人也認識到了這一點。

不過,旅美經濟學家何清漣表示,人民幣升值只能減少今後外匯儲備的增加,影響國內貨幣存放數量。最可能的結果就是抑制了出口,但是對抑制物價上漲所起的作用有限。

蓋特納承認,中國自去年6月以來,允許人民幣對美元的匯率上升了大約5%,但美國國會議員和生產廠家認為,人民幣幣值被壓低了多達40%,使中國商品在世界市場上特別便宜。

北京大學「中國宏觀經濟研究中心」的經濟學家黃益平,對美國《華爾街日報》表示:中國領導人仍嚴格控制人民幣的升值步伐,平均每個月升值0.5%左右。他認為,人民幣的自由浮動可以是有條件的浮動,讓市場決定匯率高低。現在央行官員贊同他的觀點,但決定權在高層領導人。

中共高層為甚麼不能放開人民幣匯率呢?

經濟時政評論家草庵居士認為,人民幣匯率的根本問題在於,國際貿易中各個國家都實行自由匯率,而中共政府控制匯率,這就造成眾多貿易上的不平衡,擾亂了全球經濟秩序。並且,中共政府把老百姓海外掙到的每一分錢都要交給政府,然後對內印發鈔票。這樣中共政府有了大筆外匯儲備,成了它手中的一個主權基金了。

草庵居士(經濟時政評論家):“所以看到這點就知道中國外匯制度的存在,中國(共)政府不願將外匯制度改為自由外匯制度,不願意讓老百姓手中握有外匯,它根本想利用這筆錢維持自己的統治,這是關係到中共命運的一個大的事情。所以在這點上,中國(共)政府在整個外匯制度上,他們寸步不讓,想辦法在維持自己的政權底線。”

有人認為,如果人民幣升值將大大影響中國的出口,因此反對人民幣升值。對此,黃益平說,要讓中國在將來能夠強勁增長,就得讓出口企業學會生產附加值更高的產品,或者是將生產從沿海地區向工資水平更低的內地搬遷,這才是實現可持續增長的辦法。

新唐人記者宋風、周平綜合報導。

======

Exchange Rate Still in Focus

Next week U.S.-China strategic economic dialogue

will be held in Washington D.C. and RMB

exchange rate is still in the focus. Geithner,

the U.S. Treasury Secretary hopes that RMB

appreciation will accelerate. Scholars believe

however, that the Chinese government

will not let go of the RMB exchange rate.

"US-China Strategic Economic Dialogue" led in its

3rd round by US Secretary of State and Geithner,

and Chinese Vice Premier Wang Qishan, will work

on issues of bilateral relations development.

Geithner said recently that he would urge Chinese

officials to implement a series of economic reforms,

including introducing more flexible exchange rates

driven by market forces, and improving

U.S. companies investing environment.

Geithner also said the focus of this talk will be

the currency exchange rate of RMB to USD.

RMB appreciation is good to curb China』s inflation,

also it can prevent expanding of real estate bubble

in China. Chinese leaders also recognize this.

U.S. economist Ho Qinglian said RMB appreciation

can only curb foreign exchange reserves, reducing

domestic money deposited. Most likely it can inhibit

the export, but effect on price increases is limited.

Geithner acknowledged that since last June, China

has allowed the rate of RMB to USD to increase

by about 5%. U.S. congressmen and manufacturers

believe RMB value was down by as much as 40%,

making Chinese goods on markets very cheap.

Huang Yiping, an economist in China's

Macroeconomic Research Centre in Peking Univ.

told Wall Street Journal that Chinese leaders still

tightly control RMB appreciation with 0.5% a month

on average. He believes that RMB could float freely

with conditions letting the market determine its level.

Central bankers agree with his views,

but senior leaders are in control of the decisions.

Why the Chinese Communist Party's (CCP)

top levels do not free the exchange rate?

Buddhist Hermitage, a politeconomy critic believes

the fundamental issue is that only CCP and China

out of all countries does not use free exchange rate

in international trades, causing trade imbalances

and disrupting global economic order.

The Chinese government demands every penny

earned overseas and then prints more money.

The government thus owns a large

foreign exchange reserve as a sovereign fund.

Buddhist Hermitage said, "From this we know how

China's foreign exchange system exists. China

(CCP) is reluctant to free foreign exchange system,

unwilling to let the people hold foreign exchange.

CCP wants to use the money to maintain its rule,

related to its fate. On foreign exchange rate

China (CCP) is unwilling to compromise and tries

to find ways to maintain its political power."

Some people think RMB appreciation will greatly

affect China's exports, so they go against it.

Huang Yiping said that to make export enterprises

have strong growth, one must learn to produce

higher value-added products, or move production

from the coastal area to mainland

where wage level is lower.

This is the approach to achieve continuous growth.

NTD reporters Song Feng and Zhou Ping.

看下一集

【禁聞】中國女排背毛詩 “紅風”嚇跑外商

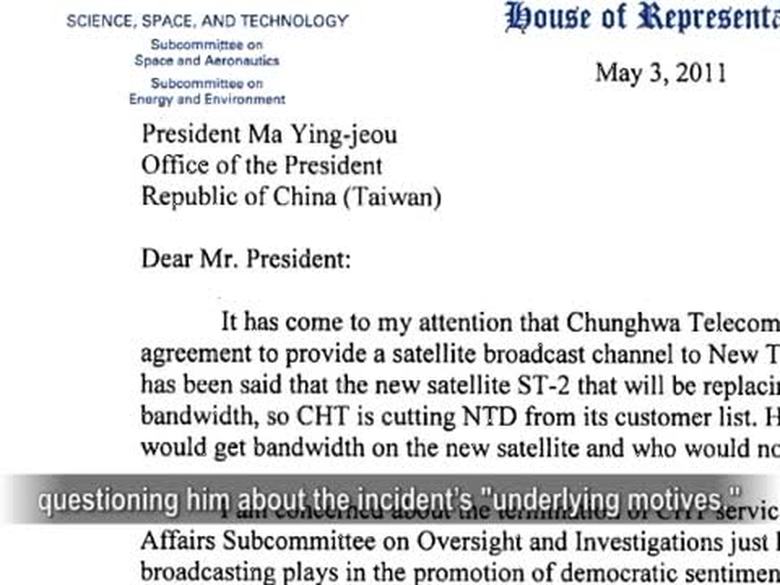

【禁聞】台灣新唐人遭噤聲 美國議員關注

【禁聞】中共軍報披露:退黨在軍內引反響

【禁聞】“恐怖主義土壤說” 官民看法不一

【中國禁聞】美器官移植界擬禁止與中共交流

【禁聞】美參議警告百度 放鬆網路審查

【禁聞】外匯損失驚人 中共做傻事?

【禁聞】拉登死後 國際反恐的目標是誰?

【禁聞】全國一片紅 文革離中國有多遠?

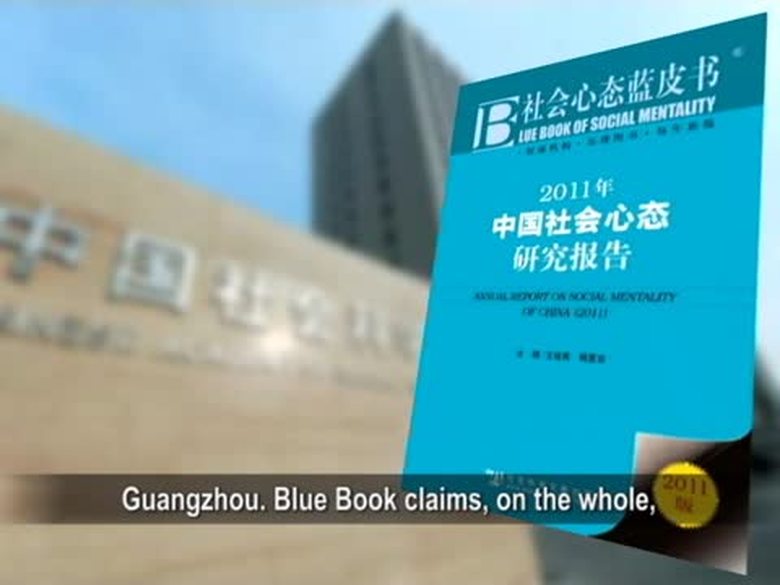

【禁聞】藍皮書稱百姓生活“有滋味”

【禁言博客】派出所為防盜派人給汽車放氣

【禁聞】香港吹紅風 “國民教育”被斥洗腦

【禁聞】拉登死後 國際反恐的目標是誰?

【禁聞】民眾量身定做 五毛黨之歌

【禁聞】中共「國母」宋祖英臺北唱紅歌

【禁聞】媒體被令造“太平紅海”