【新唐人2011年11月23日訊】近年來,大陸民營企業生存越發艱難。最新一項官方調查顯示,超過八成的民營企業家認為稅負過重,更有超過三成半說「如果重新選擇,不願再經營企業。」專家指出,中共當局一方面不斷盤剝民企,另一方面又壓制民企、大肆扶持作為中共黨產的國有企業,大陸民企前景堪憂。

這份由「中國民主建國會」(簡稱「民建」)與中國企業家調查系統,在20號聯合發佈的《2011年千戶民營企業跟蹤調查報告》,集中調查了上千名民營企業家。報告顯示,超過八成的企業家認為企業稅費負擔「很重」或「較重」。 23.6%的企業家表示,向各級政府交納的亂攤派費用超過企業銷售收入的「1%以上」,明顯高於去年的調查。

對此,政治經濟評論家草庵居士表示,現在中國每年的稅收增長遠遠高出GDP增長,稅負沉重是事實。

草庵居士:「這些稅收哪裏來的?在中國(中共)政府的國營企業當中,中石化等三大巨頭,它們都是虧損的,利潤也不交給政府,它們交的稅收也是很少的。所以,在這種情況下,我們就可以得出一個結論,中國大量的稅收實際上是來源於私營企業。」

草庵居士認為,大陸民企承擔了大量就業,但因為沒有官方背景,只能被任意宰割,前景堪憂。

草庵居士:「中國(中共)政府是把這些國有企業看作是自己的親生兒子,把私人企業看作任意宰割的羔羊。民營企業受到(經濟危機)衝擊的時候,它還是不忘去加倍盤剝這些民營企業。所以,民營企業在中國的發展,承擔的責任會更重,負擔也更重,這對中國民營企業的發展是一個很大的傷害。」

這份報告還顯示,接近三分之二的民營企業家認同「未來一年國際經濟形勢將會惡化」,並表示「對市場化改革信心不足。」更有超過三成半的人直言「如果重新選擇,不願再經營企業。」凸顯大陸民營企業家們的艱難處境與心態。

2008年全球爆發金融危機,中共當局為刺激經濟,向國有企業過度投資而引發資產泡沫。現在,中共被迫實施經濟硬著陸,收緊銀根,這使08年後處境一直很困難的民營企業雪上加霜,紛紛倒閉。

大陸媒體報導,僅9月25號一天,溫州就有9個老闆因資金鍊斷裂而「跑路」, 9月27號,一家鞋業老闆更因欠債4個億跳樓自殺。而這一趨勢目前還在蔓延,深圳、東莞、義烏、佛山等地也紛紛傳出有老闆「跑路」、企業倒閉。

紐約城市大學教授陳志飛:「這的確是中國經濟發展中,一個原來大家從未想到的一個變數。因為外界普遍認為:中國的企業、中國的運營環境,越來越開放,越來越自由,越來越市場化。但是現在看來,事情是在按照相反的方向發展。」

陳志飛教授強調,國有企業實際上是中共的黨產,雖然民企在GDP中曾一度佔主導,但中共並不信任民企,而是將資源和資金投向國企。外界調查顯示,目前大陸國有化加快,國企又重新佔據了經濟主導。陳志飛教授還指出,稅收其實也是中共壓制、控制民營企業的一個手段。

陳志飛教授:「使得民營企業被迫採取各種方式,賄賂啊,或者是打壓它的企業職工啊,逼迫民營企業做出一些違背道德、而有利於共黨利益的事情。比如說:在鎮壓法輪功的事情上,逼迫民營企業, 保持跟它(中共)一致,抗拒民營企業工會,等各種方面,它對民營企業都採取這種脅迫的方式。」

據報導,「民主建國會」的這個調查已經持續了8年多。今年的調查涉及不同行業、不同地區、不同規模的企業,問卷都是由企業的法人代表直接填寫的。

新唐人記者代靜、李謙、肖顏採訪報導。

China』s Private Business Not Happy

Private enterprises in China became more difficult

to survive in the recent years.

A latest official survey shows that over 80% of private

entrepreneurs think that the tax burden is too heavy.

Over 35% said, if given a re-choice,

they would not choose to run a business.

Experts point out, Chinese Communist Party (CCP) continues

to exploit the private sector, yet suppressing its development.

In contrast, CCP-controlled state-owned enterprises

are vigorously given various support.

The prospects of China』s private enterprises

might be sorrowful.

China Democratic National Construction Association(CDNCA)

and China』s Entrepreneur Survey Agency jointly issued a

“2011 Follow-Up Survey Report on

1,000 Private Enterprises”.

The report shows that over 80% of entrepreneurs think

the corporate tax burden is "very heavy" or "quite heavy."

Over 23% said that arbitrary charges and fund-raising quotas

levied by the authorities at all levels account for

over 1% of the sales revenue, significantly higher than

last year』s.

Commentator on political and economic issues, Cao』an Jushi,

said China』s annual tax growth is far higher than that of GDP. The heavy tax burden is a fact.

Cao』an Jushi: "Where are these taxes coming from?

The state-owned enterprises, the Big Three, including

Sino-pec Group, are all in the red.

They don』t deliver any profit to the government,

paying very little tax.

So we can conclude that China』s huge amounts

of tax revenue come from the private sector."

Cao』an Jushi believes that China』s private enterprises

create great amounts of jobs.

But due to lack of official background, they could only be

arbitrarily suppressed and exploited by the CCP authorities.

Cao』an Jushi: "China』s (CCP) government treats the state

owned enterprises as its own, the private sector is only considered as their servant.

On top of being hit by the economic crisis, private enterprises

suffer from the double exploitations of the authorities.

Thus in China private enterprises have to take on board more

responsibilities and heavier burdens, which is a great harm to their development.”

The report also reveals that nearly two-thirds of the private

entrepreneurs think "in the coming year, the international economic situation will deteriorate."

They state that they "lack confidence

in the market-oriented reforms."

Over 35% frankly say, "If given a re-choice,

I wouldn』t like to run a business.”

The survey highlights the plight and state of mind

of private entrepreneurs in China.

In order to cope with 2008 global financial crisis, the CCP

stimulated the economy by excessive investments in state-owned enterprises, which led to asset bubbles.

Now, the CCP undertook an economic hard landing,

by tightening the funding.

This caused the worse plight in which private enterprises

have been trapped since 2008, and many businesses failures.

According to China』s media reports, on September 25 alone,

nine Wenzhou-based bosses fled due to lack of cash flow.

On September 27, a shoe factory owner committed suicide,

after becoming indebted for RMB 400 million.

This trend still expands, with more boss-fleeing cases

and business failures in Shenzhen, Dongguan, Yiwu, Foshan and other cities.

Prof. Chen Zhifei (City University of New York): "This is really

an unexpected variable in China's economic development.

Previously, a general understanding was, China』s enterprises

and business environment will be increasingly open, increasingly free, and more and more market-oriented.

But now it seems that things are heading

in the opposite direction."

Prof. Chen stressed that China』s state-owned enterprises

are actually controlled by the CCP.

Though the private sector was once dominant in GDP,

the CCP authorities did not trust private entrepreneurs.

Instead, they invested resources and capitals overseas.

External surveys show that currently China』s nationalization

is being accelerated.

The state-owned enterprises

regained the economic dominance.

Prof. Chen points out that the tax levy is also a mean

for the CCP to repress and control private enterprises.

Prof. Chen Zhifei: "The CCP authorities forced private

enterprises to take various approaches.

Like paying bribes, suppressing its employees,

doing some unethical things in favor of CCP』s interests.

For example, CCP forced the private enterprises to stay

in line with its suppression of Falun Gong, to resist private enterprise trade unions, etc.

All along, it forces the private enterprises

in such a coercive way.”

CDNCA』s survey was reported to have taken

over eight years to conduct.

2011 survey involves different sectors, regions

and enterprises of different sizes.

All the questionnaires are filled personally

by the enterprises』 legal representatives.

NTD reporters Dai Jing, Li Qian and Xiao Yan

看下一集

【禁聞 】韓國逮捕器官中介 中共活摘遭譴責

【禁聞】大城市房產交易量大降 波及產業鏈

【禁聞】“三公”消費 國務院出條例限制

【禁聞】史上最牛的民告官案

【禁聞】粵放寬維穩媒體 汪洋角逐最高權位

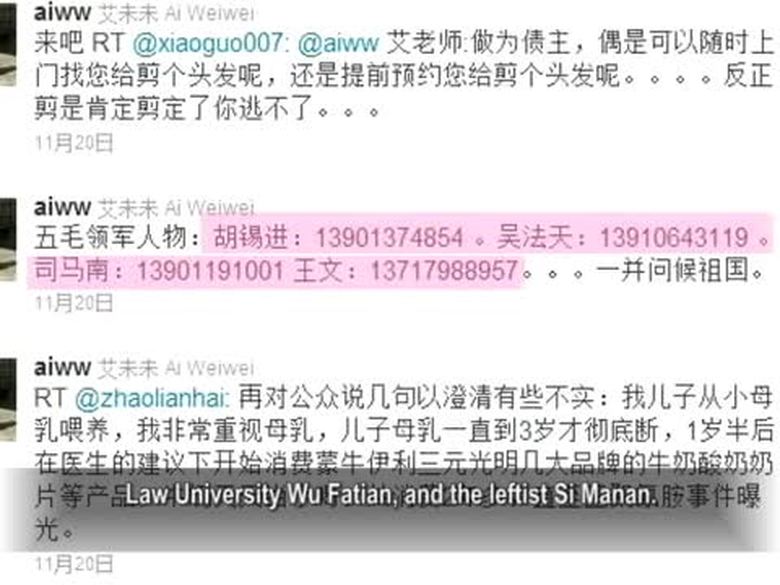

【禁聞】艾未未反擊 民眾譴責環球時報

【禁言博客】絕不允許改變的權力運作方式

【禁聞】微博用戶超三億 控網令北京頭疼

【禁聞】海歸進退兩難 「千人計劃」難兌現

【禁聞】失蹤一年多 高智晟生死成謎

【禁聞論壇】中國真實的通脹率是多少?

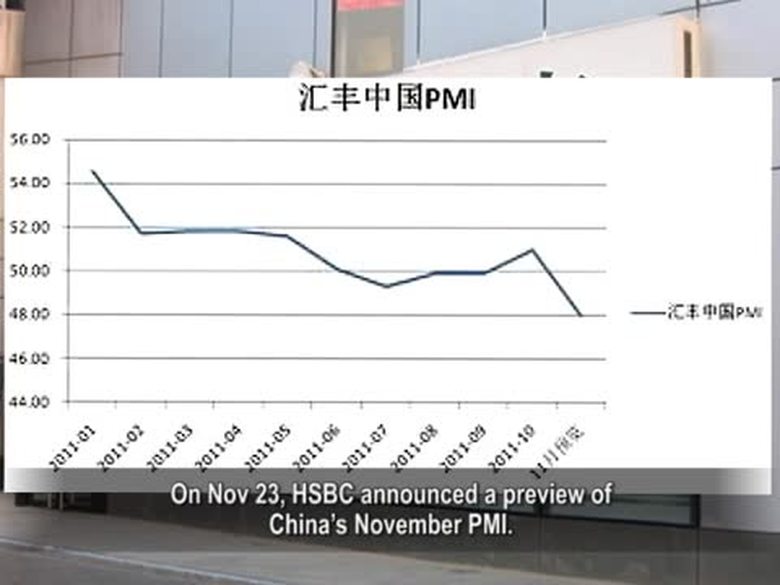

【禁聞】專家:中國製造業萎縮 滯脹前兆

【禁聞】民主人士: 關注陳光誠不「幫倒忙」

【禁聞】人民幣能匹敵美元 肥皂泡再現

【禁聞】網上叫陣吳法天 健崔遭拘引質疑

【禁聞】世界媒體看中國:反對制裁伊朗