【新唐人2012年2月28日訊】近來,中國四大龍頭房地產企業帶頭掀起的樓市降價風潮,正在中國蔓延,很多房地產企業紛紛跟進。市場人士預計,更大規模的促銷會在3月份展開,這是自去年10月底以來中國樓市的第二波降價潮。北京經濟學家茅于軾認為,房價下降50%都不過份。

在北京當局樓市調控政策的重壓下,2月份國家統計局發佈的數據顯示,1月份中國70個大中城市新建商品住宅價格全面停漲,其中,降價的城市有48個,持平的城市有22個。

1月份,中國大部份城市的土地成交量明顯下跌,地價節節滑落。大型房企的銷售大幅下滑,16家標桿房企1月份銷售總額不足300億元,不及去年同期的一半。

標普、瑞銀國際等金融機構近期紛紛預警,2012年中國房地產信貸大量到期,由於銷售回款不力和短期債務壓力,2012年部份房企可能面臨現金流危機。

近期,保利集團在上海新推出200多套房,單價從每平方米1.9萬元降到1.7萬元。保利在中國40多個城市聯合促銷,共涉及2萬套房源。

隨後,另一家龍頭企業「招商地產」22個在售項目同時啟動優惠活動,部分房源降價達到15%。此外,許多大型房地產企業也紛紛跟進。目前,形式多樣的促銷戰正在北京、上海、深圳等地樓市上演。

經濟學家茅于軾日前指出,中國經濟今明兩年最大的風險就是房地產泡沫破滅,因為空房太多了。

甚麼叫房地產泡沫破滅呢?茅于軾表示,就是房價不斷往下落,他估計房價不止掉30%,差不多掉50%。三年前,北京的房價就掉了這麼多。因此他不鼓勵老百姓現在出手買房。

茅于軾:「房地產泡沫的背後是幾個原因,最主要的原因就是投資渠道不暢,有錢人手裡的錢沒有地方去,就去買房子,如果有好的投資機會,他們就不會買房了。其次,我們的收入差距太大,有錢的人買好多的房,沒錢的人一個房也買不起。另外,我們的土地供給不足,土地為甚麼貴呀?國家壟斷了土地。」

自從中共當局實施限購政策以來,北京、上海、杭州、重慶、武漢、合肥、南京等17個城市出臺了不同的微調政策,其中,蕪湖、佛山、成都等因為微調幅度過大,政策頒布不久就被中央「叫停」。

最近,溫家寶和李克強強調,要堅持房地產調控不動搖。經濟學家綦彥臣表示,以固定資產泡沫帶動增長,中國經濟已經付出了昂貴的代價,房地產泡沫破裂對發展實體經濟是有益的。

綦彥臣:「降幅至少有60%,才可能出現一種甚麼樣的市場呢?真正的房地產住房消費,也就是說,你買了房子就是為了一家人住,而不是投資或者投機。政府你千千萬萬不能從房地產上貪錢,土地出讓金佔了地方財政收入的40%以上,這是為甚麼呢?就是我們的政府養閒人太多。」

經濟學家謝國忠最近也表示,房地產泡沫的破裂,會限制地方政府最大的資金來源,浪費型的項目將會終止,由此將會導致增長放緩和經濟效率提高。房價下跌的過程,將會讓財富從政府轉向居民。

新唐人記者周玉林、李元翰、李若琳採訪報導。

China’ House Prices Down By 50%, Experts Say

Recently, China's four major real estate companies

have taken the lead of lowering prices in the house market.

Many other real estate companies

are following them closely.

Market experts foresee that more large-scale promotion

will commence in March.

This will be the second price reduction

since the end of last October in China.

Beijing-based economist Mao Yushi said, it will not be

an overstatement to say that house prices are falling by 50%.

China’s house market is under a big pressure

of regulation policy from Beijing authorities.

Released by National Bureau of Statistics data in February,

shows the latest trend.

These data shows that the price of new commercial houses

in 70 large and medium-sized cities stopped rising in January.

Among them were 48 cities with price reduction,

and 22 cities holding the line.

In January, the land turnover decreased significantly

in most of China’s cities, and the land price fell steadily.

The sales of large-scale housing companies fell sharply.

The total sales of 16 benchmark housing companies were

under RMB 30 billion, less than half of that last January.

Standard & Poor's, UBS and other world financial institutions

have warned, many Chinese housing loans are due in 2012.

As a result of weak sales and short-term debt pressure,

some house companies will face a cash flow crisis in 2012.

Recently, Poly Group released 200 flats in Shanghai,

with price fall from RMB 19,000 to 17,000 per square meter.

Poly Group carried out a co-promotion

in over 40 cities in China, with 20,000 flats involved.

Another leading house company, ZhaoShang DiChan,

launched promotions for its 22 on-sale projects, and the price fall of some houses is up to 15%.

In addition, many other large house companies

also follow this pattern one after another.

Now various forms of promotional campaigns are carried out

by Beijing, Shanghai, Shenzhen and other house markets.

Economist Mao Yushi recently pointed out some risks

with China's economy.

The biggest risk of this and next' year is the house market’

bubble burst, as there are too many empty houses, thinks Mao.

What would a bubble burst of the house market mean?

Mao Yushi said this is the continual fall of the house prices.

He estimated that house prices will fall

between 30% and 50%.

Three years ago, the house price in Beijing fell that much.

So he does not encourage people to buy houses now.

Mao Yushi: "There are several reasons

behind the house market’ bubble.

The main reason is poor investment channels.

Rich people have no place to invest, and go to buy houses.

If there are good investment opportunities,

they would not buy houses.

Secondly, the income gap is too large. Rich people buy

a lot of houses, but poor people can not afford even one.

In addition, the land supply is insufficient. Why is the land

so expensive? Because the state monopolizes it."

The Chinese communist authorities implemented the policy

of house purchase restriction nationwide.

However, different regulation policies were issued in 17 cities,

including Beijing, Shanghai, Hangzhou, Chongqing, etc.

And some cities, like Wuhu, Foshan and Chengdu

had changed the policy too much.

Thus they were called by the central government to stop,

soon after issuing their policies.

Recently, Wen Jiabao and Li Keqiang stressed,

that the house market regulation policy shouldn’t be changed.

Economist Qi Yanchen said, with the fixed asset

bubbles-led growth, China's economy has paid a high price.

And that the house bubble burst will be beneficial

to the development of the real economy.

Qi Yanchen: "The decline is at least 60%,

what kind of a market could this be?

The real housing consumption’ purpose is to buy a house for

your family to live, rather than for investment or speculation.

The government should not be greedy for money

from the housing market.

The land transfer payments account

for more than 40% of the local fiscal revenue.

Why? Because there are too many idlers

in our government."

Economist Xie Guozhong also said, the house bubble burst

will limit local governments’ largest source of funding.

The wasteful projects will be terminated.

This will lead to slower growth and economic efficiency.

The process of house price falling will make the wealth shift

from the government to the citizens.

NTD reporters Zhou Yulin, Li Yuanhan and Li Ruolin

看下一集

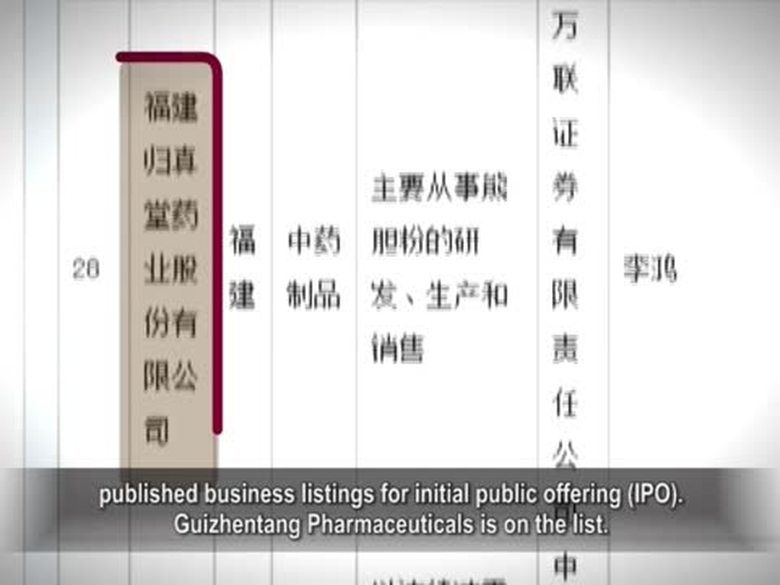

【禁聞】活取熊膽 眾人齊喊滾

【禁聞】林書豪給職業籃球注入新鮮血液

【禁聞】合肥花季少女被毀容 申冤路艱難

【禁聞】中共兩會民生重提 權鬥白熱化

【禁言博客】粉飾的和諧掩蓋不了施暴的真相

【禁聞】計生標語背後的人倫悲劇與恐怖

【禁聞論壇】「灰色收入」是分配不公的罪魁禍首?

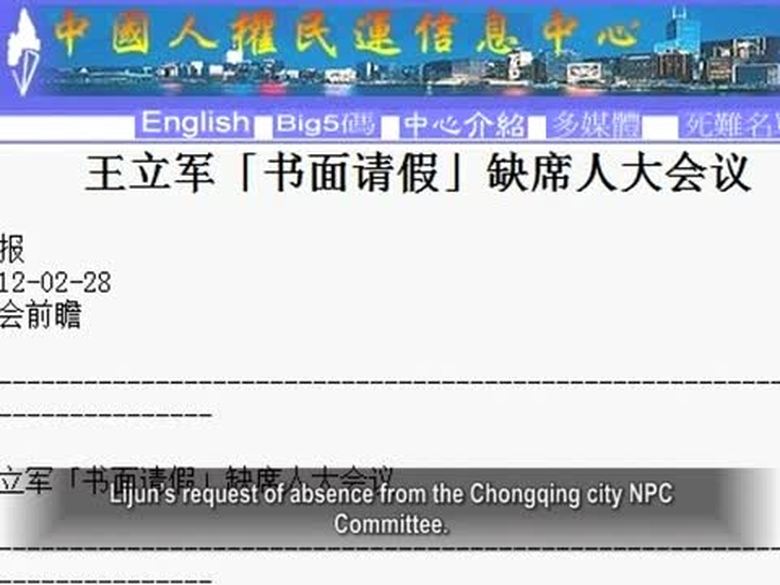

【禁聞】王立軍缺席兩會 薄熙來高調表忠

【禁聞】冤民不信任兩會 駐華使館前喊冤

【禁聞】2月29日禁聞集錦

【禁聞】中共體制下能產生林書豪嗎?

【禁聞】奧巴馬令貿易執法 解決美中失衡

【禁聞】道德崩潰釀執政危機 中共打雷鋒牌

【禁言博客】當利比亞民眾罵“China 卐”的時候

【禁聞】香港特首貪腐醜聞 學者:中共腐蝕

【禁聞】兩會前 民間吶喊聲四起