【新唐人2011年6月27日訊】正當市場擔憂中國通脹噩夢揮之不去、經濟可能走向“硬著陸”的同時,中共國務院總理溫家寶日前在英國《金融時報》撰文表態說,目前中國的物價水平 可控,壓抑通脹政策已奏效。雖然股市對此隨即作出反彈回應,但金融界分析師警告,不應將溫家寶的言論視為政策轉向的信號﹔也有專家認為,這只不過是溫家寶 出訪歐洲的外交公關。

6月24號正式開始歐洲之行前,溫家寶在英國《金融時報》發表署名文章。他表示,已將“控制大陸物價上漲”,放在宏觀調控的首要位置,並推出了一系列針對性的政策,而政策已經取得效果。

這番言論被部分市場分析師視為政策可能鬆動的積極信號,當天滬指上漲2.16%﹔上證指數成交額創兩個月來新高。但有金融股市分析師警告,現在斷言中國股市下跌行情已經結束,還為時過早。

美國南卡羅萊納大學艾肯商學院教授謝田:“因為實際上現在國際上對中國的經濟即將崩潰和硬著陸的猜想和猜測,金融上做空的舉措層出不窮。中國(共)現在還是想繼續用他的外匯儲備來更多的購買歐洲國家,尤其是那些負債纍纍的一些歐洲國家的債券。在用打歐洲牌來對付美國的時候呢,他需要營造一種中國經濟穩定繁榮的假象。”

而《路透社》引用一位不願透露姓名的資深經濟學家的分析指出,目前國際社會對中國的通脹高度關注,溫家寶撰文更多是一種公關上的需要,與政策是否放鬆並沒有必然的聯繫。

報導說,中國國際經濟交流中心研究員王軍也認為,中共領導人出訪前配合外交方面的需要,發表一些文章沒有甚麼特別。他說:“最多可能理解為貨幣政策可能不會再緊,至少加息上調存准的頻率沒那麼多,但得不出政策可能放鬆的信號。”

《亞洲新聞》則認為,中國內部經濟的穩定性仍然是一個謎。每年,中國都會上演數萬起群體抗議事件。而造成動亂的原因,從通貨膨脹到生活費用暴漲。溫家寶在國際媒體上做出這類答復,似乎更多的是為了安撫日益擔心中國經濟局勢的外籍投資者。

此外,美林美銀經濟學家陸挺注意到,溫家寶最新的言論表述,與他在4月13號的措辭有明顯差別。當時溫家寶說,“國內物價上漲比較快、通脹預期增強,房地產市場成交量萎縮、多數城市房價還在上漲,宏觀調控仍然面臨較大壓力。”

陸挺認為,儘管溫家寶發表了一些正面訊息,但因此預期當局將很快轉變政策立場,則可能是錯誤的,貨幣政策不會有太大改變。

自去年11月中國居民消費價格指數(CPI)創出5.1%的新高以後,今年CPI已經連續三個月位居5%以上,並在5月份創出5.5%的數字,是34個月以來的新高。

國家統計局日前公布:6月中旬大陸50個城市主要食品平均價格,結果豬肉價格依然大漲4%,民眾擔憂6月CPI恐將再度登頂,大陸發改委更是公開預測,6月CPI將比5月份還高。

目前分析師普遍預期6月份的通貨膨脹將達6%以上。

新唐人記者梁欣、李明飛、葛雷採訪報導。

Wen Jiabao: Inflation can be controlled

As China』s inflation remains a concern and

the economy heads towards a “hard landing”,

Chinese Premier Wen Jiabao published an article

on Financial Times to claim that

China』s overall price level is manageable.

Although stock market rebounded after its publication,

financial analysts warned that his words didn』t signal

a monetary policy change and possibly are PR tactics.

Prior to Wen』s Europe visit on June 24, he said,

China had prioritized curbing inflation

as part of its macroeconomic policy and

China had introduced a series of effective policies.

Some analysts see his comments a positive signal to

loosen monetary policy; Shanghai Index rose 2.16%.

Its trading volume was at a 2-month high. However,

some analysts warned that it』s too early to conclude.

University of South Carolina professor Xie Tian:

Due to the speculation of China』s economy failure,

short selling (of Chinese stocks) is commonplace.

Chinese authorities continue to use foreign reserves

to buy indebted European countries』 bonds.

They need to create an image of economic prosperity.

Reuters quoted an anonymous senior economist

that as the world is concerned about China』s inflation,

Wen』s article is out of the foreign relations need;

it doesn』t signal a loosening of the monetary policy.

China Center for International Economic Exchanges』

Wang Jun believes the article is nothing special.

He said, “At most, monetary policy won』t be tightened.

But it is no signal that the policy will be loosened.”

Asia News said economic stability is still a mystery

in China, as there are tens of thousands of riots

due to inflation and soaring living cost every year.

Wen』s comments are more likely made to calm down

the concerned foreign investors.

Merrill Lynch』s economist Ting Lu noticed that

Wen』s recent comments were different from

his speech on April 13. He said, “Inflation rate is rapid;

real estate trading volume dropped

while housing price in cities continue to rise.

The macroeconomic control is under great pressure.”

Lu believes that despite Wen』s positive messages,

it could be wrong to expect the Chinese authorities

to change its policy stance soon.

China』s currency policy will not be changed much.

China』s CPI hit a record high of 5.1% in Nov. 2010.

In 2011, CPI remains above 5% for three months,

and it hit a 34-month high of 5.5% in May 2011.

National Bureau of Statistics released the average

food prices in 50 cities in June 2011.

The price of pork rose by 4%.

China Development and Reform Commission

forecasted CPI in June would be higher than in May.

Analysts expect inflation in June to be above 6%.

NTD reporters Liang Xin, Li Mingfei and Ge Lei

看下一集

【禁聞】北京土地貸款亮紅燈

【禁聞】官員財產公示難產 學者:自欺欺人

【禁言博客】同足協一樣黑的證監會

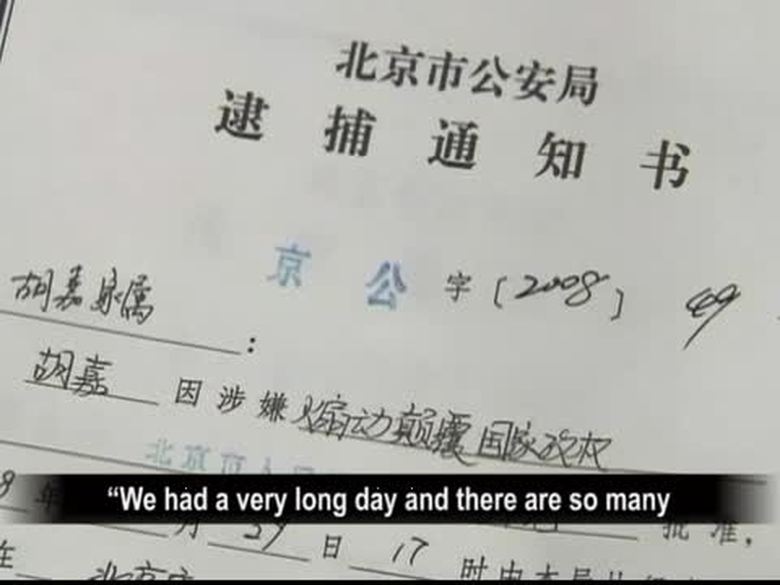

【禁聞】胡佳出獄 仍受監控

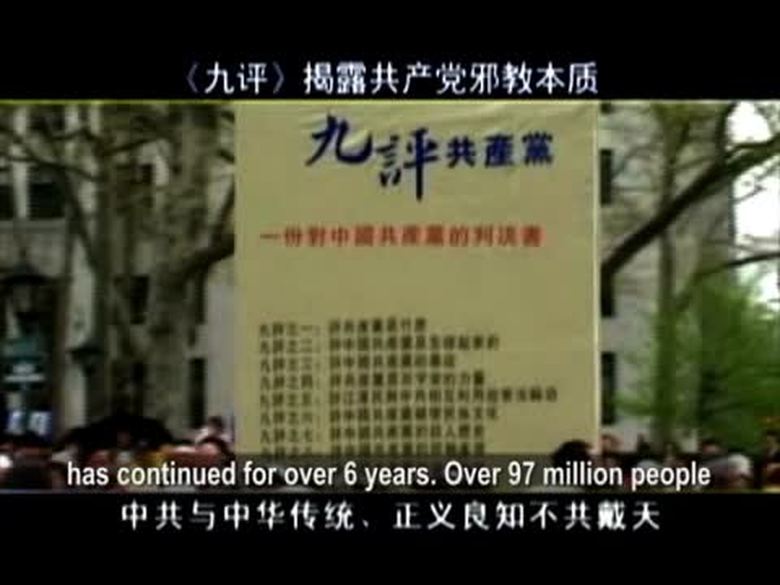

【禁聞】黨員8千萬虛假 退黨大潮解體中共

【禁聞】“垃圾圍城” 魚塘變垃圾場

【禁聞】溫家寶訪歐 人權抗議如影隨形

【禁聞】“紅十字會總經理”炫富 遭圍觀

【禁聞】“群體滅絕罪”國際罪犯 現身北京

【禁聞】7.1前北京數萬人上訪 有喊打倒中共

【禁聞】中共黨慶掀紅潮 耗資萬億失民心

【禁聞】維基解密:前中共財長中臺美人計

【禁聞】國際法庭通緝卡札菲 中國民眾叫好

【禁聞論壇】大學,上還是不上?!

【禁言博客】我只為丁俊輝 李娜喝采

【禁聞】中共建黨90週年自稱“朋友遍天下”