【新唐人2012年3月30日訊】28號,中共國務院常務會議決定,設立「溫州市金融綜合改革試驗區」,將擴大銀行對企業家的借貸,並允許溫州人到海外投資。試圖讓地下金融「地上化」。不過,外界認為,大部分貸款還是會由國有企業得到,因為國企和銀行關係密切,同時也是官員權力的基礎。

溫州是一個以出口導向的私營企業中心,由於很難從國有銀行獲得貸款,致使私人借貸發展得非常普及。2008年的金融風暴,引發溫州民間融資和借貸破產浪潮,這次溫州金融改革的目地,據說是要把借貸雙方納入一個當局能監控的結構化系統中。

在大陸經商,中小私人企業是無法獲得國有銀行的貸款,所以溫州地下金融的存在,有市場需要的理由。美國《福克斯》新聞引述美林證券經濟學家盧婷的話說,將貸款借給小微企業的最有效措施,就是允許成立更多的私營資本的小銀行。不過,前提是中國要先建立一套存款保險體系。

溫州中小企業出現資金鏈斷裂和企業主出走現象,曾經吸引了全球的關注,中共國務院為了監測民間的融資,在溫州設立金融綜合改革試驗區,並且要開放個人境外直接投資試點,讓私人投資海外的金融資產。

針對這個問題,經濟發展專家吳惠林表示,中國經濟發展成本已經向上升高,很多企業都難以生存,所以這個金融改革試驗能不能成功,他並不看好。

吳惠林:「中小企業當然是相對的弱勢,那現在只有在資金方面可以給他們做一些貸款,這個不是市場上那種做法,而是由政府有意的對特定對像然後來做一些貸款,所以是不是會最後變成一個樣板式的情況,他們在市場上沒有辦法貸到款,可能當初就是受到一些不公平待遇,或者是說制度本身他就不是那麼自由開放,所以應該是從制度的因素去改革。」

吳惠林認為,讓金融制度自由化、專業化,按市場法則來做,政府不需要跳到第一線來主導控制市場,而是在後面扮演好支援的角色。整個體制的改革還是要往市場化來發展,才能讓地下金融「地上化」。

吳惠林:「你怎樣讓這個地下金融變成地上金融,你把這整個金融開放了以後,很自然的這地下金融它就能有所管道,然後怎麼能變成地上金融,因為你管制越多,地下的不管是金融或者地下經濟越蓬勃,那你現在管制把它開放了,越來越自由化以後,那些自然或是地下金融就被淘汰了,或是它已經脫胎換骨變成地上的。」

吳惠林表示,中國在經濟這方面還是半調子,中國需要好好學習自由社會的經濟發展模式。

吳惠林:「總而言之,應該是要整個體制這種改革,而不是保持原來這種體制,然後政府作一些管控,那種方式應該是要退位了,好好去學習自由社會裏面用的那種比較好的方式。」

溫州金融綜合改革還將開放個人境外直接投資試點,不過,分析人士說,在中國經濟放緩的時候,北京對資本過度外流也會感到擔憂。盧婷還向《福克斯》新聞表示,反正中國沒有有效的措施控制溫州跨邊境資本外流,為甚麼不將它合法化呢?

採訪/陳漢 編輯/李庭 後製/孫寧

Wenzhou Pushes Underground Financing Aboveground

On March 28, the Chinese Communist Party (CCP) decided

to set up the Wenzhou financial comprehensive reform.

Bank lending is expanded to entrepreneurs in Wenzhou

and people will be allowed to make direct foreign investment.

This “pilot zone” program is attempting to bring

underground financing above ground.

However, according to outside analyses, the majority of

bank loans will still be given to the state-owned enterprises.

This is because the SOEs have close ties with the banks,

meanwhile, they provide the basis of power for the officials.

Due to difficulty to obtain loans from state-owned banks,

private lending is very popular in Wenzhou.

The 2008 financial crisis triggered bankruptcy waves

in the area of private financing and lending.

The recent Wenzhou financial reform reportedly aims to put

creditors and debtors into an officially-controlled framework.

In mainland China, small and medium-sized private

enterprises are unable to get loans from state-owned banks.

This explains the reason why underground financing

markets exist in Wenzhou.

Fox News quoted Merrill Lynch economist Lu Ting.

“A more effective measure to direct loans to smaller

companies would be to allow the establishment of more small banks with private capital,” Lu said.

“But authorities are unlikely to take such a step

until China has set up a deposit insurance system,” adds Lu.

Wenzhou was once a global focus for local medium and small enterprises suffering

from the money-off chain and bosses』 choosing to flee.

In order to monitor private sector financing, CCP』s State

Council set up a financial reform pilot zone in Wenzhou.

A pilot program will reportedly allow

individuals to make direct investments overseas.

Expert in economics Wu Hui-lin comments that China's

economic development has seen the surging cost.

A slew of enterprises face hardship in trying to survive.

Wu is not optimistic about this financial reform』 pilot project.

Wu Hui-lin: "Certainly the medium and small enterprises

are relatively weaker in their finance situations.

Now they are allowed to get loans but in a way different

from the common practice done in the market.

The government will make loans available to them

as a specific group.

Inability to get loans from the market may be caused

by the unfair treatment they received in the past.

Or you can blame the system for not being free and open.

The reform should be embarked on the institutional factors.”

Wu Hui-lin says it should follow the market rule to liberalize

and specialize the financial system.

Wu says, the government shouldn』t be a frontline dominator

controlling the market, it should be a background supporter.

Wu adds that the reform of the entire system

needs to be market-oriented.

Only in this way can underground financing

become "aboveground" one.

Wu Hui-lin: "How do you make current underground

financing aboveground?

After you open up the entire financial system,

the underground financial business will find its way to fit,

Next, how do you turn it into aboveground financing?

The more the control over underground financing

or underground economy, the more vigorous they are.

Now you free it up, underground financing will naturally

die out or be transformed into the aboveground sector."

China is still an amateur in the economic sector, and needs

to learn from the development model of free societies.

Wu Hui-lin: "In a word, it should carry out a reform

of the whole system.

It should not just preserve the original system

while adding some official control.

This pattern should be abandoned. They should learn from

the free society about the ways that have been succeeded.”

Wenzhou』s financial reform will reportedly launch

a pilot project allowing foreign investment for individuals.

Analysts say as China』s economy slows down, the CCP

will also be worried about the excessive capital outflow.

Fox News quotes Lu Ting: "There's no effective control

of cross-border capital flows in Wenzhou anyway, so why not legalize it?"

看下一集

【禁聞】"007"之死成焦點 王立軍擬先赴英領館

【禁聞】賴昌星開庭 意在「新四人幫」

【禁聞】黃奇帆無緣博鰲 胡溫已控定局

【禁聞】重慶「黑打」 嚴刑逼供怵目驚心

【禁聞】血腥摘取器官 腎移植鼻祖跳樓自殺

【禁聞】懼清算拋黑鍋 傳公檢法三巨頭請辭

【禁聞】推動公民權益 茅於軾獲經濟自由獎

【禁聞論壇】「兩會」面面觀

【禁聞】專訪封從德:中共政局變化的啟示

【禁聞】挺薄勢力反撲 抓千人刪二十萬網帖

【禁聞】薄熙來案調查延續 富商徐明被控制

【禁聞】美議員再促白宮 公布王立軍真相

【禁聞】王樂泉高調站隊 周永康勢力日衰

【禁聞】血債派清網 新一輪政治風暴前奏?

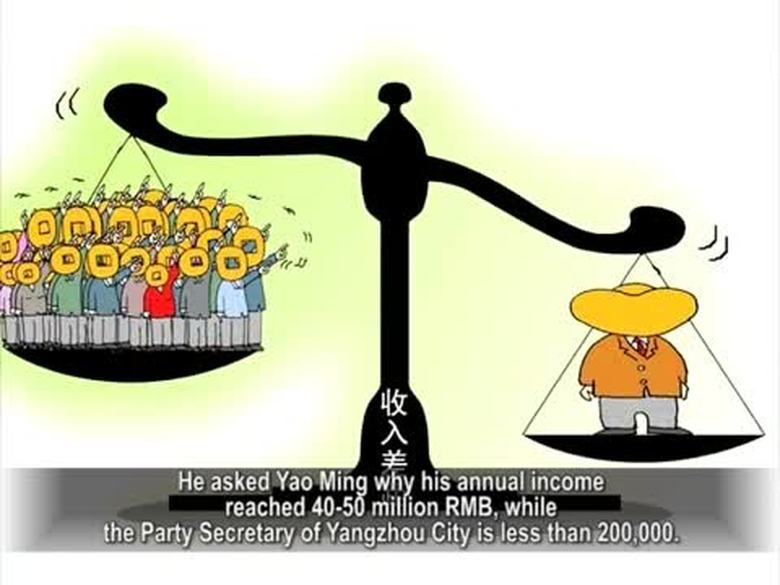

【禁聞】姚明:拿我和書記收入比較 不對!

【禁聞】胡續掌軍權 十八大後延續胡溫路線