【新唐人2011年6月25日訊】美國《華爾街日報》日前指出,中國國家債務接近於國內生產總值GDP的80%,這還不包括地方政府債務,也不包括刺激經濟貸款中提供給國有企業的其餘70%。中國海內外專家指出,政府債務綁架中國經濟,政府靠加印鈔票解決債務及不良貸款,造成通貨膨脹和房地產泡沫,最終由老百姓買單。

《華爾街日報》6月21號的這篇文章指出,2009年刺激經濟計劃產生的第一批不良貸款,即將衝擊中國的銀行系統。中共當局目前正在考慮為2到3萬億元人民幣左右的不良貸款承擔責任。

文章還說,這次救助計劃的規模,幾乎相當於本世紀初中國重組四大國有銀行時剝離的壞賬總額。具有諷刺意味的是,這項救助還大體相當於中國2008年4萬億元經濟刺激方案的規模。

《華爾街日報》的這篇文章刺激了北京當局的神經。《新華社》23號發表文章,引述財政部財政科學研究所副所長白景明的話反駁說:「這顯然高估了中國的債務規模和潛在風險。」

而總部設在香港的研究機構GaveKal Asia近日發佈的報告指出,中國公共債務佔GDP的比重在過去十年間,基本穩定在80%左右﹔中國目前的公共債務已達到2010年GDP的90%水平。

報告還說,中國地方政府債務佔GDP的比例已經超過了美國和巴西。不過,報告認為,「封閉的金融系統」,使中國幾乎不可能發生像希臘政府那樣的債務危機。

北京天則經濟研究所理事長茅於軾:【錄音】「中國的情況很特別,中國銀行不會倒閉的,因為政府做後臺。因此它對付倒閉這個問題怎麼辦呢?那就是印鈔票。銀行倒閉是甚麼意思呢?就是存進來的錢少,取出去的錢多,它沒有錢了,那時候怎麼辦呢?那時候就印鈔票。」

根據北京央行數據,到去年9月底超發貨幣將近43萬億元。《華爾街日報》6月23號的文章指出,在不太可能發生債務危機的情況下,長期以來承受重壓的中國家庭,將以某種形式為政府大多數債務買單。

經濟學家謝國忠表示,農副產品輪番上漲其實都是央行貨幣超發的結果,多餘的錢在市場中亂竄,多年纍計起來的過量貨幣,給中國經濟實體帶來了巨大的通脹風險。

而財經評論家草庵居士說:

【錄音】「因為中共大量的國債,它通貨膨脹的時候變相的把這個債務稀釋了,所以政府它想要保持一個通貨膨脹的速度。所以這就是變相的去掠奪百姓。」

《路透社》6月1號獨家援引消息人士披露,中國銀監會、財政部及發改委,計劃在6月到9月,清理可能違約的地方政府債務及銀行壞帳2到3萬億人民幣。

而中國「三星經濟研究院」預測,到今年年底,地方政府債務總額將達到12.5萬億元左右,接近去年中國GDP的的三分之一。同時,大量地方債在今年(2011年)到2013年期間,將進入還款期,中國債務風險會在未來兩三年集中爆發。

茅於軾:【錄音】「最後的結局就是印鈔票,在中國的情況﹔像美國的情況就是銀行倒閉,中國的情況銀行不會倒閉的。甚麼問題也沒有就能把壞帳問題對付過去,那是不可能的。壞帳的最後承擔者是誰?沒有別人,就是老百姓。」

另外,《華爾街日報》發表中國證券業協會李迅雷副主委的文章說,加息是讓目前資產泡沫消退的最有力手段,但房地產泡沫一旦破滅,就意味著地方政府的土地財政難以為繼,這會導致債務鏈的斷裂,最終導致銀行壞賬率大幅上升乃至金融危機。他認為,地方政府債務問題綁架了中國經濟。

而《國際財經時報》22號的文章指出,近期一些經濟學家分析擔心,即便中國經濟實現「軟著陸」,纍積如山的地方政府債務,可能導致中國經濟在今後多年增長乏力。

新唐人記者 常春 李元翰 蕭宇 採訪報導

Government Debts Undermine Economy, Who Will Pay the Bill?

WSJ reported lately, China』s national debt to GDP ratio

reached 80%. This doesn』t include local governments』

debts and the loans provided to stimulate economy.

Experts said, national debts burdened China』s economy.

The regime printed money to resolve debts and

non-performing loans, resulting in inflation.

Eventually, Chinese people will end up paying the bill.

The WSJ article published on June 21 said, the 1st batch

of non-performing loans provided in 2009 will soon

impact China』s banking system. The CCP authorities

are now considering who should be responsible for

the RMB 2 to 3 trillion yuan non-performing loans.

It also said, the scale of 2009 stimulation almost equals

to that of the reorganization of 4 top China banks.

Ironically, it』s also similar to that of the 4 trillion

economy stimulation plan in 2008.

The article obviously irritated Beijing. On June 23,

Xinhua News Agency quoted finance ministry』s

expert Bai Jingming』s refute, saying it overestimated

China』s debts scale and potential risks.

While recent reports from GaveKal Asia, a HK based

research institute, said, China』s national debt-to-GDP

ratio leveled around 80% in the past 19 year.

But in 2010, the ratio rose to 90%.

The report also said that Chinese local governments』

debts to GDP ratio has been higher than that of the U.S.

and Brazil. However, the report believes that China』s

『closed financial system』 will not bring China into

the financial crisis like in Greece.

Mao Yushi, a famous Chinese economist: “China has

a unique situation. Chinese banks will not go bankrupt

because the governments are backing them up.

Then, how do they handle the issue of bankruptcy?

By printing currency. What does it mean by a bank

going bankrupt? It is when less money coming in than

going out. What can it do then? Printing the money.

China Central Bank』s statistics show that by Sep. 2010,

additional RMB43,000 billion yuan is in circulation.

A June 23 WSJ article said, Chinese families are under

heavy burdens of unknowingly paying for the debts of

the regime not in the case of an economic crisis.

Economist Xie Guozhong said, the agri-food price hike

is the consequence of Central Bank』s issuance of

excessive currency. The excessive liquidity accumulated

over the years is freely moving around the market,

rendering Chinese economy rather vulnerable to inflation.

Caoan Jushi (financial commentator): “The CCP has

a huge amount of national debts, but inflation indirectly

dilutes its debts. This is why the CCP wants to maintain

a certain inflation rate, which is equal to rob the citizens.”

On June 1, Reuters reported China Banking Regulatory

Commission, Ministry of Finance and Development and

Reform Commission plan to clean up local government

debts and bad loans between June and Sept.

totaling about 200-300 million yuan.

According to a forecast by Samsung Economic Research

Institute in China, by the end of this year, debts of

local governments will reach 12.5 trillion yuan,

almost one-third of China's GDP last year. Meanwhile,

a large portion will enter the repayment period

between 2011 and 2013. China's debt crisis can

break out in two or three years.

Mao Yushi: "The final outcome is printing money,

that is what will happen in China; If it is in the U.S.

there』ll be bank failures, but China won』t have bank failures

It』s impossible that the bad loan problem will disappear

as if nothing has ever happened. Who will pay for

these bad loans? Nobody, but the Chinese citizens.

WSJ also carried an article by Li Xunlei, assoc. director,

Securities Assoc. of China, saying interest hike is

the best way to control the real estate bubble.

Once the bubble is burst, the local governments

will have difficulty renewing their revenues,

causing the debt chain to break and non-performing

loans to increase, or even financial crisis to occur.

He believes the local governments』 debts

have undermined Chinese economy.

International Financial Times reported on June 22,

some economists worry that even if China』s economy

takes soft landing, the mounting debts of the local

governments will cripple Chinese economy for years.

NTD reporters Chang Chun, Li Yuanhan and Xiao Yu

看下一集

【禁言博客】股民何時不做“韭菜姑娘”

【禁聞】城建啟示錄:一場大雨讓北京癱瘓

【禁聞】《我是黎智英》成禁書 緣起“六四”

【禁聞】訪歐公關? 溫家寶:物價可控

【禁聞】北京土地貸款亮紅燈

【禁聞】官員財產公示難產 學者:自欺欺人

【禁言博客】同足協一樣黑的證監會

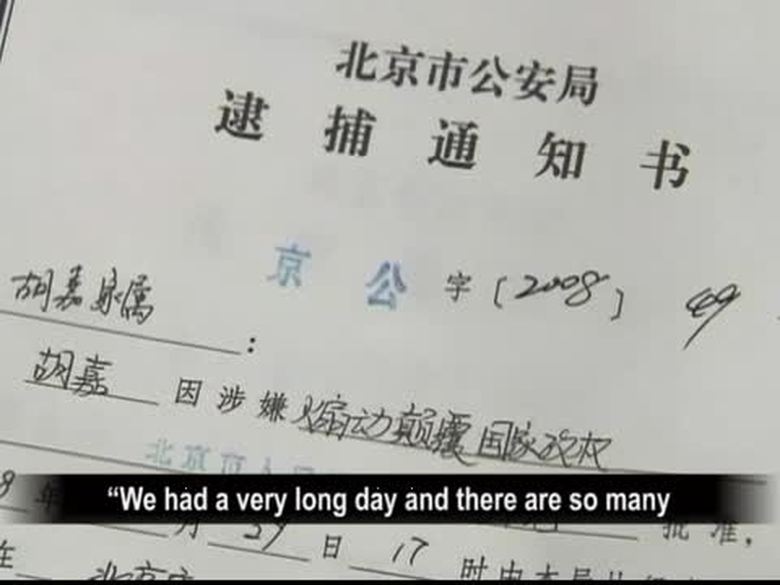

【禁聞】胡佳出獄 仍受監控

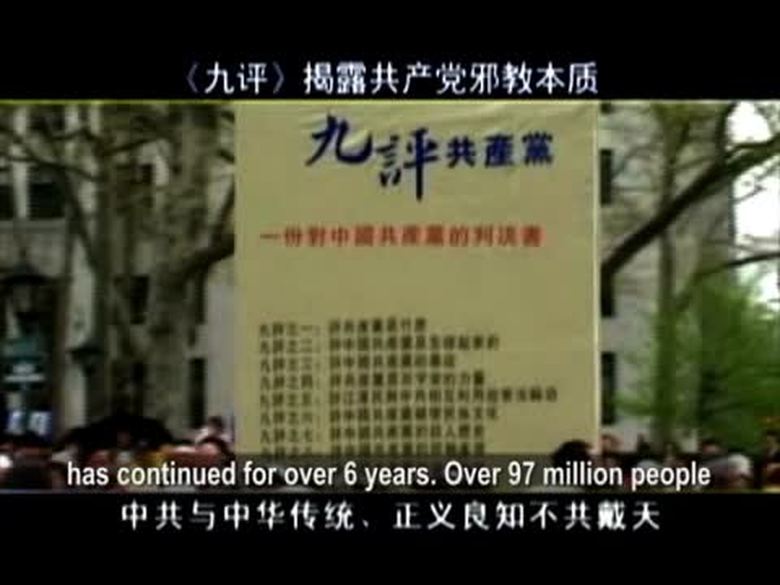

【禁聞】黨員8千萬虛假 退黨大潮解體中共

【禁聞】“垃圾圍城” 魚塘變垃圾場

【禁聞】溫家寶訪歐 人權抗議如影隨形

【禁聞】“紅十字會總經理”炫富 遭圍觀

【禁聞】“群體滅絕罪”國際罪犯 現身北京

【禁聞】7.1前北京數萬人上訪 有喊打倒中共

【禁聞】中共黨慶掀紅潮 耗資萬億失民心

【禁聞】維基解密:前中共財長中臺美人計