【新唐人2011年12月2日訊】中國11月份製造業出現萎縮,創下2009年初全球金融危機以來的最低水平。11月30號,大陸央行近3年來首次下調存款準備金率。一些媒體和經濟學家認為,中國政策重心已從抑制通貨膨脹轉向促進經濟增長和創造就業﹔而北京官方學者並不認為中國貨幣政策的基調發生了改變。

中國11月份製造業採購經理指數(PMI)從10月份的50.4降到49,這是自2009年2月以來首次跌破50這一臨界點。PMI數值高於50表明製造業活動擴張,低於50則表明收縮。

「中國物流與採購聯合會」發佈的官方PMI指數,表明通貨膨脹壓力繼續減退。11月份新出口訂單指數從10月份的48.6大幅降到45.6,《華爾街日報》指出,這表明歐美經濟衰退正對全球的中國商品需求構成影響。

通過下調存款準備金率0.5個百分點,央行實際上向銀行業體系注入了約4000億元人民幣,從而使得銀行可以向日益減速的經濟投放更多貸款。

英國《金融時報》說,這是對連續兩年貨幣政策逐步收緊的一個逆轉。兩年來北京當局一直試圖為經濟增長降溫,同時抑制物價的持續上漲。

另一方面,11月份全國100個城市的房價,連續第三個月環比下降,並創出今年以來最大環比降幅。全國樓市銷售量都出現大幅下滑。

「紐約城市大學」經濟學教授陳志飛認為,比較「通貨膨脹」和「硬著陸」,中共政府還是選擇先解決「硬著陸」問題。

陳志飛:「由於中國政府沒有採用國際慣例,利用儲蓄率、銀行貸款利率來調整流通,而是採用了銀行準備金的這種方式,將會使這些現金,很大程度上流入國營企業或者是房地產信貸產業,這樣可能會造成房市的捲土重來。」

中共副總理李克強日前表示,明年將堅持實施房地產調控措施。《華爾街日報》說,隨著流動性的放鬆,這項工作的難度將增大。政府面臨的挑戰將是引導額外的貸款流入中小企業,而不是豪華住宅樓開發商之手。

《人民日報》說,中國這次下調存準率並不是針對房地產行業,更不意味著房地產宏觀調控政策的放鬆,也難以改變房價下降的趨勢。

《華爾街日報》則表示,中國放鬆貨幣政策的行動時間早於多數經濟學家的預期,經濟學家們預計中國未來數月將進一步放鬆信貸。

國務院發展研究中心金融研究所副所長巴曙松認為,這次下調存準率,是為了緩解銀行體系流動性偏緊的局面,穩定增長將被擺在更重要的位置,但並不意味著穩健的貨幣政策的基調發生改變,未來物價走勢仍有不確定性。

陳志飛:「中國政府陷入一個進退兩難的境地。如果採取寬鬆政策,會導致通貨膨脹的上升。如果不這樣做,中國經濟就會硬著陸。」

中國大陸的央行下調存準率出臺幾小時後,美聯儲、歐洲央行、日本央行等發達國家六大央行宣佈,向有需要的任何銀行提供更低息的美元貸款。

知名財經評論家葉檀表示,全球主要央行的聯合救市行為,意味著以貨幣緊縮為代表的市場正常化努力,在債務危機的倒逼下宣告失敗。央行的寬鬆行為,說明以往的貨幣泡沫所釀造的貨幣危機已到不可收拾的地步。

葉檀指出,放鬆貨幣政策只能短期鎮痛,救不了實體經濟。全球實體經濟缺的不是資金,而是新的經濟增長點、新的盈利模式,以及對於此前的高福利政策的反思。此時逼迫銀行貸款、企業投資,只能惡化未來的資金配置,導致進一步的產能過剩。

新唐人記者李元翰 蕭宇 報導

Beijing Cuts Reserve Ratios

China』s manufacturing sector started to shrink in November,

falling to its lowest level since the global financial crisis.

On November 30, China』s central bank cut

its bank reserve ratios for the first time since 2009.

Media professionals and economists comment,

that China's monetary policy prioritization has shifted.

It moved from curbing inflation

to promoting economic growth and creating jobs.

However, Beijing regime』s official scholar

does not admit this shift.

China』s official Purchasing Managers Index (PMI) fell to 49

from 50.4 in October,

the first time below the tipping point since February 2009.

A reading above 50 indicates manufacturing』s expansion,

while a value below 50 indicates contraction.

Released by China Federation of Logistics & Purchasing,

official PMI showed inflationary pressure continued to decline.

The new export orders index in November plunged to 45.6

from 48.6 in October.

Wall Street Journal』 reports say this indicates that economic

recession in Europe and the US affected the global demand for China』s commodities.

China』s central bank cut reserve ratios by 50 basis points,

equating to injecting cash RMB 400 billion into the banking system.

The action enables the banks to offer more loans

to the increasingly slowing economy.

UK』s Financial Times said that this is a reversal

of its monetary policy after more than two years of tightening.

The Chinese Communist Party (CCP) regime has been trying

to cool economic growth while suppressing price rising.

Additionally, the housing prices in 100 cities in China dropped

for a third consecutive month, the highest decrease in 2011.

Nationwide property sales have dropped sharply too.

Economics professor at the City University of New York,

Chen Zhifei said, out of the inflation and hard landing issues, CCP』s authorities have chosen to solve the hard landing.

Chen Zhifei: "This is because China』s authorities didn』t adopt

the international practice of using savings』 interest rate and bank loan interest rates to adjust the cash flow.

Rather, it adjusted the bank reserves.

This will enable the cash to largely flow into the state-owned

enterprises or the real estate credit market, which might result in a comeback of housing market bubbles.”

CCP』s Vice Premier, Li Keqiang, said recently that in 2012,

real estate control measures shall be firmly implemented.

Wall Street Journal commented that the relaxation of cash

liquidity will increase the task』s difficulty.

The CCP authorities』 challenge is to lead the extra loans

into the small and medium enterprises, instead to the hands of real estate developers.

According to CCP』s mouthpiece People's Daily,

the reserve ratios cuts do not aim at the real estate sector,

nor do they signal for easing up the real estate market control,

neither help changing the downward trend of housing prices.

Wall Street Journal said that China released easing

of monetary policy earlier than most economists expected.

The economists estimate further easing of credit terms

in the next few months.

The Deputy director of Institute of Finance at State Council

Development Research Center, Ba Shusong, explained why.

Ba said, the official reserve ratios cuts were to ease

the banks』 tight liquidity situation.

The steady growth would be prioritized, but this

does not mean to change the prudent monetary policy.

Ba believes the future price trend still remains uncertain.

Chen Zhifei: "China』s regime faces a dilemma.

If it adopts a liberal policy, this will lead to a higher inflation.

If it fails to do that however,

China』s economy will have a hard landing."

A few hours after the China』s bank reserve ratios cuts,

six central banks in developed countries made an offer.

US Federal Reserve, European Central Bank and Bank

of Japan amongst others, offered loans in US dollars at a lower interest rate to any bank in demand.

Renowned financial commentator Ye Tan said,

the global major central banks』 joint bailout is indicative.

It means, market normalization efforts of monetary tightening

had collapsed under the pressure of debt crisis.

China』s central bank easing policy shows the monetary crisis,

caused by the past monetary bubble, is out of hand.

Ye Tan points out that the easy monetary policy can only be

a short term painkiller, but it can』t be helpful to the economy.

The global economy does not lack funds, but new economic

growth points, new profit models, and a reflection of the high welfare policies of the past.

Forcing now banks to give loans and businesses to invest,

can only worsen the fund allocation misbalance and the overall situation..

NTD reporters Li Yuanhan and Xiao Yu

看下一集

【禁聞】「紅色後代」囂張 西方媒體聚焦

【禁聞】艾未未稅務案 妻子律師皆被擾

【禁聞】外媒:緬甸與中國漸行漸遠

【禁聞】報喜不報憂 能美化道德環境?

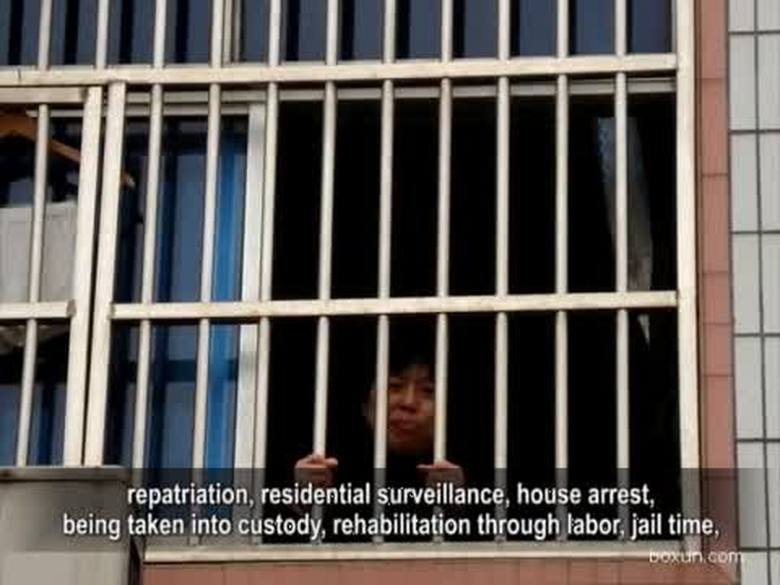

【禁聞】迫害陳光誠 臨沂選文明城 民眾痛責

【禁聞】美中拆遷戶 命運大不同

【禁聞】山東副省長傳貪560億 包養46情婦

【禁聞】「民主是好東西」 中國人難擁有

【禁聞】問題動車復出 高鐵安全再履薄冰?

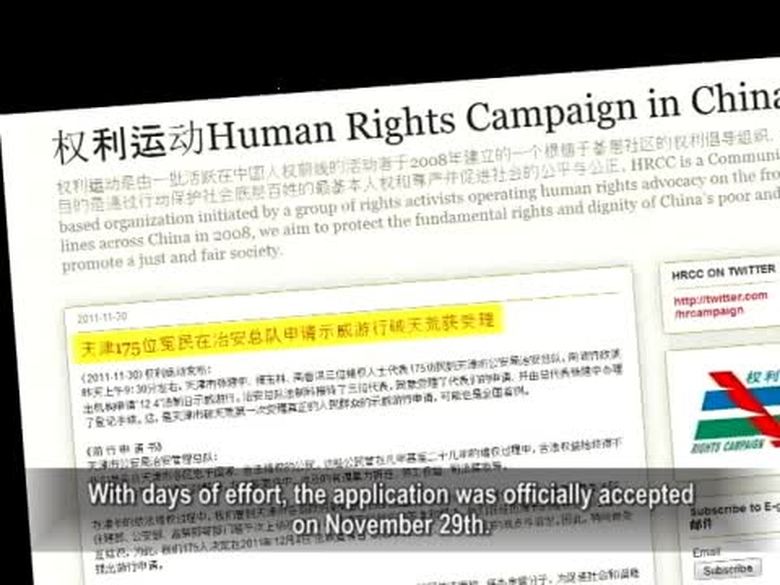

【禁聞】視訪民如敵人 公安監控軟件曝光

【禁言博客】等級如此森嚴,還奢談甚麼和諧

【禁聞】美國緬甸關係升溫 中共緊張﹖

【禁聞】中共「法制宣傳日」有宣傳沒法治

【禁聞】台灣大選辯論民主示範 陸官冷民熱

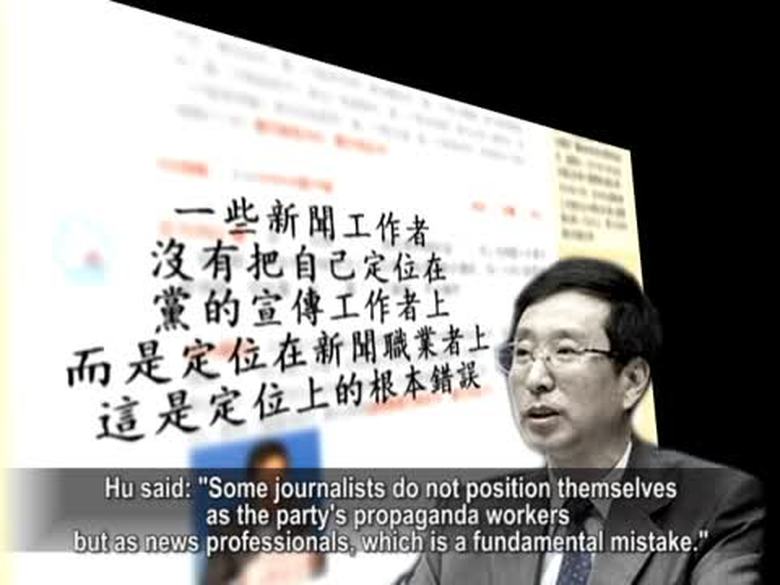

【禁聞】央視新臺長「喉舌」語錄引非議

【禁言博客】GDP世界第二與我何干?