【新唐人2011年4月7日訊】大陸央行最近宣佈再次加息,將一年期存貸款基準利率提高0.25個百分點。這也是今年(2011年)以來的第二次加息。分析人士認為,這顯示大陸通脹壓力加劇,當局擔憂社會不穩。民眾則指責當局轉嫁通脹壓力,最終買單的還是老百姓。專家預測,大陸的通脹狀況還會繼續惡化。

根據大陸央行4月5號宣佈的加息決定,自4月6號起,將金融機構一年期存貸款基準利率分別上調0.25%,其他各檔次存貸款基準利率及個人住房公積金貸款利率也做了相應調整。調整後,一年期存款利率為3.25%,一年期貸款利率達6.31%。

《華爾街日報》指出,大陸央行這次加息,說明央行對於第二波通貨膨脹和食品價格再度大幅上漲,非常擔憂,而且,預測3月份非食品類價格漲幅可能也會比較大。此前,中國2月份通脹率達到4.9%,與1月份持平。很多專家預測,3月中國居民消費價格指數(CPI)將再創新高,突破5%。

《穆迪經濟》網站的中國經濟學家成旭對《美國之音》表示,央行可能希望通過加息,抑制通貨膨脹、遏制固定資產投資、降低房產泡沫風險。

但國際經濟研究機構「凱投宏觀」(Capital Economics)分析認為,當局的經濟刺激措施導致信貸過量,才是通脹的真正原因。加息並不能解決信貸過量這一關鍵問題。

BBC的分析也指出,中國社會貧富差距越來越大,現在,貧窮家庭的食品消費佔到全家收入的一半。同時,房價、能源及食品價格的上漲,已經影響到中等收入家庭的生活。當局加息的用意在於緩解社會壓力,防止過高的通脹率可能導致政權不穩,發生類似中東、北非的反獨裁運動。

而大陸很多民眾,對於央行的加息做法並不認同。網民指出,當局這是在轉嫁通脹壓力,最終買單的還是老百姓,“當權者又把手伸進老百姓的錢袋子裡。”大陸大量的“房奴”更是因為房貸的不斷上漲而叫苦連連。

據大陸媒體報導,這次提高利率,對靠借貸買房的人影響最大,1年期貸款率為6.31%,5年期以上則從6.6%增加到6.8%。

《搜狐》網站的遼寧網友說,現在老百姓有錢去存款嗎?有點錢全貸款買房了,結果房貸漲了又漲。吃虧的還是老百姓。

網友指出:“人民幣對外升值,對內貶值,當局在國內外兩頭便宜全佔,卻讓可憐的老百姓買單,真是空前絕後呀!”

還有網友感概:“發覺國家調控甚麼,甚麼就漲。調房價每調每漲,調物價越調越漲,調甚麼漲甚麼,這不是耍我嗎?”

也有網友明確指出,方法只有一個,央行少發行些貨幣,啥問題都解決了。

據了解,這已經是央行半年來第4次加息,今年(2011年)以來,央行更曾3次上調存款準備金率。

經濟學家謝國忠對《搜狐》財經表示,決策層似乎想通過宣傳,讓老百姓相信通脹已經得到控制;當企業要求漲價的時候,又通過約談做思想工作,使企業推遲漲價。他說,政府相信“心理戰”,相信行政的力量,但通脹問題仍然會繼續惡化。

《穆迪經濟》網站的成旭也認為,大陸的糧食、石油和金屬這三大塊商品,價格都會上漲,所以通貨膨脹會繼續加劇,央行會繼續加息。

新唐人記者李謙、黎安安綜合報導。

China Interest Rate Rise Criticized

China』s Central Bank plans to raise interest rates,

increasing the yearly interest rate by 0.25%.

This is the second interest rise in 2011.

Analysts believe authorities are concerned

that the increasing inflation pressure will cause

social instability. People accused the government

in shifting the inflation pressure onto the masses.

Experts predict China』s inflation will keep worsening.

According to Central Bank, on April 6 banks

are to increase the yearly interest rate by 0.25%.

Other base interest rates and personal housing

accumulation fund loan rates are adjusted too.

After the adjustment, the yearly deposit rate

is 3.25%, and the lending rate is 6.31% per year.

Wall Street Journal pointed that this rise shows

China』s Central Bank is worried about inflation

and food prices』 recent dramatic increase.

It predicted the probability of another large-scale

non-food product price increase in March.

Earlier, the inflation rate in February was 4.9%,

the same as in January. Many experts predict

China』s CPI hit a new high in March, passing 5%.

Cheng Xu, a Chinese economist at Moody's,

told Voice of America, “China』s Central Bank

may want to raise interest rates to curb inflation,

reduce fixed-asset investment,

and lower the risk of a housing bubble.”

However, research institution Capital Economics

thought authorities』 economic stimulus has led

to excessive credit, the real cause of inflation.

Rate hikes can』t resolve the excessive credit issue.

BBC's analysis also pointed out that

the wealth gap is continuously widening.

Poor families spend half of their income on food.

The rise of housing prices, energy and food prices

has affected middle-income families』 living standards.

Authorities want to alleviate social pressure

through raising interest rates,

to prevent them from causing regime』s instability.

Many people disagree with interest rate increases.

Netizens pointed out that this is shifting

the inflation pressure onto the people.

"The ruling class』s hands are in people』s pockets."

"House slaves" complain about rising mortgages.

Chinese media reported that this interest rate rise

affects mortgagers the most. The yearly mortgage

rate is 6.31%, and the 5-year mortgage rate

increased from 6.6% to 6.8%.

A netizen from Liaoning wrote on Sohu.com:

“Do people now have money to deposit in banks?

They spend all their savings to pay down payments.

As the mortgages keep on rising, they lose out.”

Another netizen said: “RMB appreciates globally,

but depreciates within China.

Authorities take the advantage from both sides.

The poor people pay the price.”

Another said: “What the government controls

is price rises. The housing and commodity prices

all rise under the regime』s control.

Are authorities playing the people?”

Some netizen said: “There is only one way out.

The Central Bank should print less money.”

This is the fourth interest rate hike in six months.

In 2011, it raised the deposit reserve ratio three times.

Economist Andy Xie told Sohu Finance

that decision-makers want to make people believe

that inflation is under control, through propaganda.

When firms demand to increase the product prices,

they were taught ideological work by authorities.

Xia said authorities believe in 』psychological warfare』

but the inflation will continue to deteriorate.

Moody Finance』s Cheng Xu also believes

that in China, the prices of food, oil and metals

will rise. So inflation will continue to rise,

and Central Bank will continue raising interest rates.

NTD reporters Li Qian and Li Anan

看下一集

【禁聞】大陸師道變味 「好學生」向錢看

【禁聞】「黃金密檔」揭國民黨「保命本」

【禁聞】中共造九路冤魂 冤二代要翻案

【禁聞】卡扎菲遭聯軍重創 網易駁中共辯護

【禁聞】艾未未被指「經濟犯罪」 各方質疑

【禁聞】中共黑手觸鄰邦 美大使臨走挺人權

【禁聞】老虎對付嬰兒? 中共為何怕艾未未

【禁聞】國共兩黨入黨誓詞比較 嚇人一跳

【禁聞】國共兩黨入黨誓詞比較 嚇人一跳

【禁聞】“中央巡視組”接訪民 訪民仍挨打

【禁聞】我的護照為甚麼中共做主?

【禁聞】我的護照為甚麼中共做主?

【禁言博客】小學生搞“官場”賄選

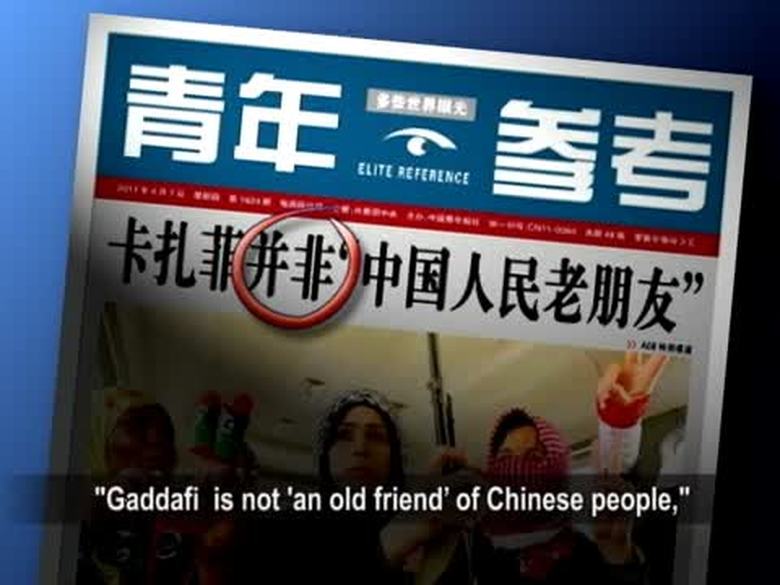

【禁聞】中共放氣球?官媒稱卡扎菲非朋友

【禁聞】末日慌亂? 中共狂抓

【禁聞】全球尋找艾未未 墨鏡哥道國人心聲