【新唐人2011年6月27日訊】在許多中外媒體對中國經濟是否會「硬著陸」議論紛紛的當兒,中國卻亮出了另一盞紅燈:北京的土地儲備貸款超出2500億元。專家指出,這是中共腐敗的結果,而且不只是北京,很多地方都面臨同樣問題。

根據大陸媒體報導,接近北京市國土局的人士透露,從2009年至今年(2011年)5月,北京市「土地儲備貸款」總規模已經超過2500億元。從今年(2011年)初開始,大規模還本付息已經開始,每月需還本付息在100億元以上。然而,今年1-5月,北京土地出讓總收入才只有250.6億元。

北京「大岳諮詢公司」總經理金永祥說:「不只是北京,受嚴厲調控政策的影響,地方政府賣地收入下降,由於前幾年過度依賴銀行『土地儲備貸款』,進行土地一級開發和基礎設施建設,全國很多地方現在土地儲備貸款償還壓力都十分巨大。」

據了解,「土地儲備貸款」,是指政府部門為「儲備土地」而向銀行提出的借貸,主要是「土地儲備部門」以低廉價格從農民手中購買土地,然後再以天價拍賣出去,拍賣後的所謂「土地出讓金」拿來歸還貸款。

財經評論員余豐慧指出,在2009年和2010年,北京土地出讓收入總共為2600億元,償還貸款綽綽有餘。但他表示, 「由此分析得出,北京土地出讓金收入並沒有用來歸還貸款,而是挪作他用了。」

5月31號,朝陽區國土局的負責人在一個土地推介會上透露,光是朝陽區「土地儲備貸款」的每天利息多過1300萬元,相當於一架飛機的價格。

《環球時報》評論說,北京土地財政接近破產的邊緣,中國以房地產為主要抵押品,以「造城運動」作為主要燃料的這種激進式經濟發展模式,將告一段落。

報導出來後,消息在網上迅速轉貼,中共企圖「和諧」,卻不成功。

網友「好想當公僕」說:「官員們可使勁的揮霍,最後是屁民買單。」﹔也有網友認爲「地方政府負債太大,加息是不敢的了,不加息呢,物價又不得了,看來是無解了」。有人說:「北京尚且如此,其他地方可想而知。怪不得有人說中國就是一個巨大的龐氏騙局。」

余豐慧表示:我們不必惋惜土地財政臨近破產,因為土地財政破產,對轉變地方政府官員的政績觀,對保護土地、抑制高房價都有利。有破才有立,土地財政破產後必將迎來一個符合科學發展觀,更加健康的房地產發展方式。

而周亞輝在《中國行將崩潰的七大特徵》文章裏的第一個特徵,就是提出:國家財政問題。

文章寫道:中共最近幾十年,靠挖礦賣礦來錢和賣地來錢,維持財政收入的快速增加,以維持財政開支的快速增加的需要。但是,土地是有限的,低價徵地引發民怨,中共的財政收入將來難以維持那麼大的水平,「所以,中共政權會因為財政危機而崩潰。」

新唐人記者吳惟、李若琳綜合報導。

Beijing』s Mortgage Crisis

As media debate on whether Chinese economy

will have a "hard landing," another red light blinks.

Beijing's mortgages for land exceed RMB 250 billion.

Experts said, it is the result of the corruption of

the communist government (CCP).

Many places in China are facing the same problem.

Chinese media report that a source close to

Beijing』s Land Bureau said, from 2009 to May 2011,

Beijing released 250 billion 『land reserve mortgages.』

In early 2011, the borrowers began mortgage payments

for the principals and interests, which are estimated

to exceed RMB 10 billion per month. However,

from Jan. to May 2011, Beijing only receives 25 billion.

Jin Yongxiang, GM of the Da Yue Consulting Firm

said, impacted by the strict control policies, Beijing and

other cities』 revenues from land sales all declined.

Excessively relying on “land reserve mortgages”

for land and infrastructure development, many local

governments are now under pressure to repay debt.

"Land reserve mortgages” refer to the mortgages

issued by banks to the governments to "reserve lands.”

The land reserve departments buy lands at low prices

and then auction them at high prices.

The profit from the so-called "land transferring fees"

will be used to repay the mortgages.

As financial commentator Yu Fenghui pointed out,

in 2009 and 2010, Beijing』s land transfer revenues

totaled RMB 260 billion, enough to repay mortgages.

However, “Beijing didn』t use it to repay the mortgages,

but use it for other purposes.”

An official of Chaoyang District Land Bureau

said at a land promotion conference on May 31,

in Chaoyang District alone, the daily interest on

“land reserve mortgages” exceeds RMB 13 million.

Global Times commented that

Beijing』s land finance is close to bankruptcy,

and China』s radical economic development model of

using real estate as collateral and "City Construction”

as the fuel, will come to an end.

The news were quickly spread by online posts.

The CCP tried in vain to remove the new report.

A netizen said, "The officials』 extravagance will

eventually end up being paid by the people.”

Another netizen said, "The local governments have

too much debt, but they dare not raise interest rates.

Without raising interest rates, inflation is increasing.

There seems to be no solution."

Some believed that China is a huge Ponzi scheme.

Yu said, let』s not regret land finances』 near-bankruptcy,

which is in fact beneficial to reverse local officials』

mentality for achievements, protect the land and

curb skyrocketing housing prices. After the bankruptcy,

a healthier real estate development will usher in.

In Zhou Yahui』s article

"The 7 Characteristics of China's Impending Collapse"

the 1st characteristic is: the state's financial problems.

It said, the CCP maintains a rapid revenue increase

by selling ores and lands in the recent decades,

in order to keep up with rapidly increased expenditure.

However, land is limited, and the CCP』s land acquisition

at low prices has led to people』s grievances.

The CCP is unable to sustain its revenues this way.

"So, the CCP regime will collapse for fiscal crises."

NTD reporters Wu Wei and Li Ruolin

看下一集

【禁聞】官員財產公示難產 學者:自欺欺人

【禁言博客】同足協一樣黑的證監會

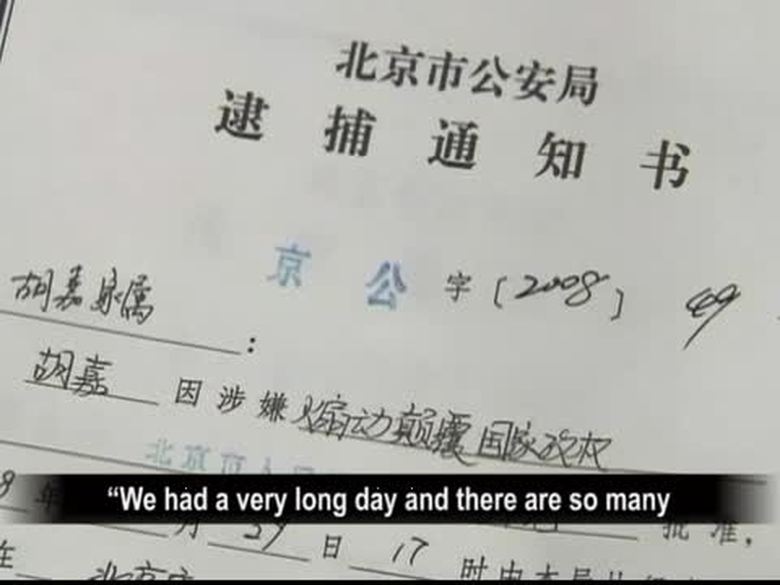

【禁聞】胡佳出獄 仍受監控

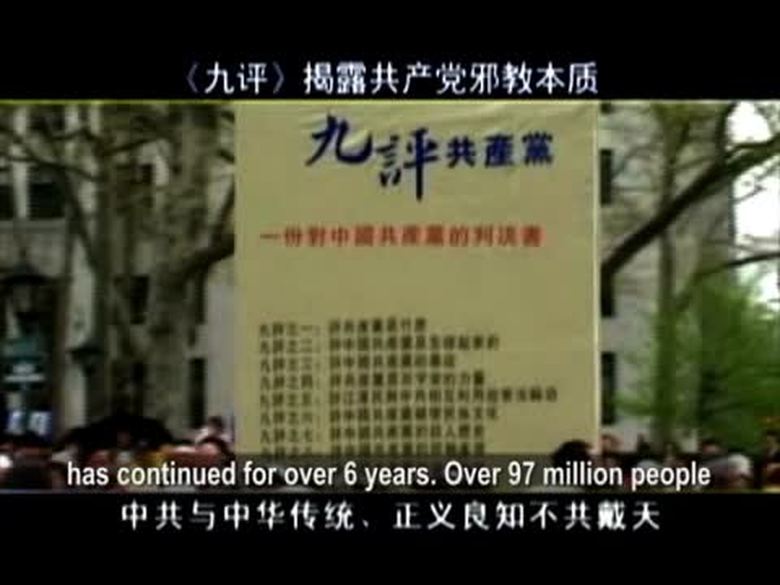

【禁聞】黨員8千萬虛假 退黨大潮解體中共

【禁聞】“垃圾圍城” 魚塘變垃圾場

【禁聞】溫家寶訪歐 人權抗議如影隨形

【禁聞】“紅十字會總經理”炫富 遭圍觀

【禁聞】“群體滅絕罪”國際罪犯 現身北京

【禁聞】7.1前北京數萬人上訪 有喊打倒中共

【禁聞】中共黨慶掀紅潮 耗資萬億失民心

【禁聞】維基解密:前中共財長中臺美人計

【禁聞】國際法庭通緝卡札菲 中國民眾叫好

【禁聞論壇】大學,上還是不上?!

【禁言博客】我只為丁俊輝 李娜喝采

【禁聞】中共建黨90週年自稱“朋友遍天下”

【禁聞】黨報稱黨員先進遭轟 建黨宣傳挨批